The battle against financial fraud hinges on swiftly identifying anomalies hidden within massive volumes of transactional data. These anomalies, difficult to detect through traditional data analysis methods, demand innovative and precise visual analytic practices to uncover concealed fraudulent patterns. With financial crime evolving rapidly, businesses can no longer afford cumbersome or outdated detection mechanisms. Unveiling these hidden insights through effective data visualization techniques is not just beneficial, it’s imperative. In this article, we explore the critical role that visualization plays in detecting financial crime, the patterns revealed by advanced data analytics, and how modern visualization practices keep firms one step ahead. Whether leveraging familiar visualization tools or consulting experts, understanding these analytics-driven visualization methods could mean the difference between prevention and losses mounting into millions. Our team at Dev3lop offers Advanced Tableau Consulting Services to strategically empower your business to spot and mitigate financial fraud efficiently.

The Importance of Visualization in Fraud Detection Strategies

Financial data volumes continue to grow exponentially, posing challenges for traditional fraud detection procedures. Manual exploration of datasets is prohibitively time-consuming, while simplistic benchmarking and alerting systems can miss nuanced fraudulent schemes. Today’s financial institutions, therefore, leverage visualization techniques to rapidly and significantly improve fraud detection capabilities. Visualization not only transforms complex datasets into easily digestible forms, but it also empowers analysts to discern patterns indicative of financial crimes quickly. While tabular data formats often obscure subtle signals, visual graphs, charts, and plots uniquely illustrate suspicious timing, distribution discrepancies, and anomalous transactions.

One sophisticated visualization approach for comparing distributions across groups to detect significant deviations is through the usage of Ridgeline plots. This innovative chart type allows organizations to quickly discern outlier distribution patterns in customer or account behavior, revealing shifts that would typically be overlooked by standard statistical approaches. By visualizing data from multiple perspectives, stakeholders can swiftly formulate strategic risk responses based on valid and easily communicated insights rather than unreliable data or hasty conclusions.

Furthermore, interactive visual dashboards can expedite collaborative analysis within compliance and risk management teams. These dashboards incorporate drill-down features, geographical mapping of transactional behaviors, and timelines illustrating sequences of suspicious events, facilitating intuitive decision-making at an unparalleled speed. Organizations maximizing visual analytics in fraud management strategies experience reduced financial vulnerabilities, decreased false positives, and enhanced operational agility.

Leveraging Graph-Based Visualizations for Uncovering Sophisticated Financial Crime

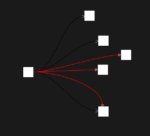

Financial fraud schemes frequently involve complex webs of relationships between entities, accounts, and transactions. To accurately detect these intricate schemes, businesses are increasingly integrating graph database technologies with visualization capabilities. These graph-centric visualization techniques adeptly uncover relationships, flow patterns, and complex network interactions that are instrumental in isolating fraud rings and organized crime networks.

Effective integration of graph-based data lineage visualization provides risk analysts with the ability to trace the origin, pathway, and eventual points of suspicious transactions through sprawling, hidden networks. This provides unprecedented clarity to analysts, auditors, and regulatory bodies, transforming ambiguous relational data into transparent visual storytelling. Graph visualization, powered by connected-node and edge representation, quickly illustrates the movement patterns of funds across accounts or parties, enabling more effective preventive measures or immediate interventions.

Additionally, deploying graph visualizations to map transaction networks helps financial institutions expose the structure and accounts involved in money laundering, terrorist financing, or tax evasion schemes more rapidly. Combining sophisticated visualizations with advanced analytics significantly accelerates an organization’s ability to respond proactively to existing or emerging fraud threats. Ultimately, integrating these powerful visual representations strengthens institutions’ underlying data-driven capabilities, reinforcing trust among customers, partners, and regulatory agencies alike.

Visualizing Volume and Velocity: Identifying Fraud through Outliers and Data Skew Detection

When spotting financial fraud, speed and precision are essential. Fraudulent activities often manifest as deviations in transaction frequency, volume, or amount compared to typical customer behavior. Visualizing transactional outliers and operationalizing data skew detection facilitates rapid identification of suspicious behavior patterns. Financial institutions must closely monitor high-velocity transactional streams where fraudsters attempt to camouflage illicit transactions within legitimate activity clusters. Visual analytical platforms, enhanced with machine learning algorithms, elevate the detection accuracy of abnormal clusters or anomalous transaction spikes in real-time.

The application of real-time anomaly visualizations, paired with alerting functions, can drastically diminish manual review times and enhance fraud analysts’ operational efficiency. By instantaneously depicting transactional velocity and volume anomalies through heat charts, time-series plots, or scatter plots, proficient analysts can zero in on precisely when and where financial misconduct occurs. Furthermore, visual exploration tools that aggregate and normalize data offer a clear lens into transaction authenticity, showcasing how data normalization techniques significantly streamline integrity checks and anomaly detection practices.

Tackling fraud visualization effectively requires a robust data analytics backbone, and this depends heavily on solid granular storage performance. Utilizing best storage practices enables the visualization layer to render large datasets faster, leading to quicker identification and resolution of suspicious transactions. Proper deployment of this visualization-centric analytical pipeline places businesses at the forefront of maintaining financial integrity and regulatory compliance.

Integrating Business Glossary and Technical Metadata in Fraud Visualization

One common obstacle facing financial institutions is misalignment between technical metadata (how data is defined and structured) and business terminologies (how business users understand data). This gap can significantly delay fraud investigation processes and negatively impact compliance reporting. Consequently, forward-thinking organizations are increasingly incorporating Business Glossary Integration directly alongside visualization dashboards. Such integrations significantly accelerate time-to-insight, aligning analysts with consistent terminology, directly embedded within investigative visualization tools used to spot fraudulent activities.

This strategic alignment of business glossary and technical metadata allows analysts and decision-makers to interpret visuals swiftly, confidently, and precisely. Experts who visualize technical relationships with clear, well-defined business contexts ensure that stakeholders can collaborate much more effectively. With streamlined concepts, professionals across different business units understand complex fraud schemes instantly, making reporting more cohesive, clear, and actionable.

Incorporating integrated glossaries can notably empower leadership visibility within the organization. Such visual strategies enable comprehensive transparency, foster accountability, and ultimately ensure better informed, data-driven decision-making processes. Crucially, this alignment capabilities becomes intrinsically valuable, not only for compliance but also maximizing organizational agility in proactively responding to evolving financial crime threats.

The Future of Fraud Detection Visualization: Embracing AI and Advanced Analytics

With disruptions constantly reshaping financial landscapes, risk managers and fraud detection professionals must adopt ever-advancing analytics practices to ensure their vigilance and accuracy in detecting crimes. Emerging technology trends indicate a significant shift toward sophisticated data science-driven visualization solutions powered by machine learning and artificial intelligence (AI). The growing responsibilities of data engineers in the age of AI epitomize the demand for strong analytical pipelines capable of handling the real-time volume, velocity, and variety of transaction data within increasingly interconnected financial ecosystems.

Modern business intelligence visualization tools, backed by advanced AI algorithms, systematically adapt to examine patterns more accurately and preemptively isolate suspicious behavior through predictive analytics. Similarly, organizations are now closely studying environmental or societal factors that indirectly influence fraud risks—for example, companies like Dev3lop that apply data analytics for sustainable urban environments exemplify the broadening range of analytics applications beyond traditional business practices.

In conclusion, fraud visualization techniques represent not merely preventative measures, but strategic competitive advantages for businesses ready to embrace the intersection of innovation, analytics, and technology. Aligning strategic visual fraud detection methods alongside robust analytics practices will determine the edge companies maintain in a highly digitized financial landscape.

Thank you for your support, follow DEV3LOPCOM, LLC on LinkedIn and YouTube.