Fraud prevention is all about speed and precision. In a digital world where transactions happen in milliseconds, businesses can no longer afford delays. Enter webhooks—the silent game-changers that enable real-time alerts and actions. This article will break down what webhooks are, how they work, and why they’re essential for fraud detection.

What Are Webhooks?

Imagine this: you’re expecting a delivery. Instead of calling the delivery company for updates, they notify you the moment your package arrives. That’s how webhooks work in the digital space.

Technical Definition

A webhook is an HTTP-based communication mechanism that sends real-time data from one system to another whenever a specific event occurs. Unlike traditional APIs, webhooks push data automatically, eliminating the need for constant polling.

How Webhooks Work

Webhooks are event-driven.

Say “event-driven” go ahead.

So, event-driven? What am I talking about?

Here’s a step-by-step, high level breakdown about webhooks.

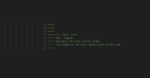

- Triggering Events: An action—like a login attempt or a high-value transaction—occurs in a system.

- Data Payloads: The system gathers relevant details (e.g., user ID, timestamp, amount) into a structured payload.

- Push Notifications: The payload is sent to a pre-configured URL (the webhook endpoint) in another system.

- Actions Taken: The receiving system processes the data and triggers appropriate actions, such as flagging the transaction or notifying the fraud team.

Why Webhooks Are Perfect for Fraud Detection

Fraud happens fast, and so must your response. Webhooks enable this by providing instant notifications, allowing businesses to act in real time.

Key Benefits

- Immediate Alerts: Fraud teams receive notifications seconds after suspicious events occur.

- Seamless Integration: Webhooks connect systems like payment processors, CRMs, and fraud detection platforms.

- Customizable Actions: Responses can be automated, such as locking accounts or escalating cases to analysts.

Webhooks in Action – Fraud Detection Use Cases

Use Case 1: Account Takeover Prevention

A suspicious login attempt triggers a webhook, sending data to an anti-fraud service. The service automatically blocks the IP and requires additional authentication.

Use Case 2: Real-Time Monitoring

Webhooks continuously send data to dashboards, providing fraud teams with a live feed of activity. This allows analysts to detect trends and respond proactively.

Setting Up Webhooks for Fraud Prevention

Getting started with webhooks involves a few key steps:

- Define Events: Identify which activities (e.g., high-value transactions) should trigger webhooks.

- Create Endpoints: Develop secure endpoints that can receive webhook payloads.

- Secure the Connection: Use HTTPS, token authentication, or HMAC signatures to prevent tampering.

- Test and Monitor: Regularly test webhooks to ensure reliability and review logs for suspicious activity.

Best Practices for Securing Webhooks

Webhooks are essential for fraud prevention, offering a reliable way to detect suspicious activity in real-time.

Unlike spreadsheets—which are prone to human error and can even contribute to fraud through mismanagement—webhooks operate dynamically over the internet, providing a more secure and efficient solution. Let’s face it: spreadsheets, while useful, are a breeding ground for mistakes and FRAUD. So, professionally speaking, it’s time to move forward, embrace webhooks, and ditch the error-prone manual spreadsheet processes that generate fraud.

Here are some best practices:

- Validate Payloads: Ensure the incoming data matches expected formats.

- Restrict Access: Only accept requests from whitelisted IPs.

- Use Time Stamps: Block replay attacks by validating timestamps in payloads.

- Encrypt Data: Protect sensitive information with strong encryption.

The Future of Webhooks in Fraud Detection

As digital ecosystems grow more complex, the role of webhooks will expand. Future innovations may include:

- AI-Enhanced Webhooks: Integrating machine learning to analyze payloads before triggering actions.

- Adaptive Webhooks: Dynamically adjusting thresholds for fraud detection based on real-time data trends.

Conclusion – Why Webhooks Are a Must-Have for Fraud Prevention

Let’s face it, not all companies desire fraud prevention and that takes times before you can start to unwind this desire to keep fraud unmanageable and in a spreadsheet, however webhooks bridge the gap between event detection and action, making them indispensable in the fight against fraud.

By enabling real-time alerts and customizable responses, they empower businesses to stay one step ahead of fraudsters. Whether you’re securing a payment gateway or monitoring user activity, webhooks are the backbone of a modern fraud detection strategy.

Perhaps unfamiliar with webhooks, how they play out with fraud prevention, but want to take advantage? Contact our data engineering consulting team today!